As the digital age propels us forward, the convenience of mobile banking has become an integral part of our daily lives. The ability to manage finances on the go has transformed the banking experience, offering unprecedented levels of efficiency. However, with this great convenience comes the great responsibility of maintaining security and safeguarding our sensitive financial information. In this detailed guide, we're going to provide you with valuable advice to make your mobile banking not just effective but also safe. Let's integrate mobile banking into your routine with confidence!

Embracing the Digital Shift in Banking

In recent years, the shift towards digital banking has accelerated, with mobile banking apps becoming a staple on smartphones worldwide. Users value the convenience of being able to view their balances, settle bills, and move money around with merely a few quick clicks. However, as our financial activities increasingly move online, the importance of secure banking practices has never been more critical. Understanding how to navigate the world of mobile banking safely can protect your finances and give you peace of mind. This guide will provide you with all the necessary instructions to ensure a smooth and safe mobile banking experience.

Selecting a Reputable Mobile Banking App

First and foremost, ensure that you're using an official mobile banking app provided by your bank or financial institution. To mitigate the risk of downloading harmful software, it is advisable to obtain the app via reputable channels such as the Google Play Store or the Apple App Store. Always verify the app's publisher and read reviews to confirm its legitimacy and performance. A reputable app will provide a secure platform for all your banking needs, backed by your financial institution's guarantees and support.

Protecting Your Device and App with Strong Passwords

Your first line of defense in mobile banking security is a strong, unique password for your device and the banking app. When creating passwords, steer clear of simplistic and predictable choices such as "123456" or "password." To bolster the robustness of your password, it's recommended to employ a sophisticated concoction of uppercase and lowercase alphabets, numerals, and symbols. If you're concerned about remembering all of your unique passwords, think about utilizing a password management tool. For an extra layer of security and to streamline your login process, you can also enable features like fingerprint scanning or facial recognition technology.

Regularly Update Your App and Device

Keep your mobile banking app and smartphone's operating system up to date. Developers often issue updates to fix security flaws and enhance app performance. Neglecting these updates may make your app vulnerable to documented threats. In order to maintain the most up-to-date and secure version of your banking application, you should either enable your device to automatically download and install updates or routinely check for and apply any available updates manually.

Utilizing Secure Network Connections

When accessing your mobile banking app, always use a secure, private Wi-Fi network or your mobile data connection. Public Wi-Fi networks can be unsecured and susceptible to interception by cybercriminals. When connecting to public Wi-Fi, it's advisable to utilize a VPN, or Virtual Private Network. This tool secures your internet connection by encrypting the data you transmit, safeguarding your personal information against unauthorized access.

Being Vigilant Against Phishing Attempts

Phishing is a common tactic used by fraudsters to trick individuals into providing sensitive information. Be cautious of unsolicited communications requesting your banking details or directing you to login pages. Always verify the authenticity of messages and never click on suspicious links. Your financial institution will never request your password or personal identification number (PIN) via email or SMS. If you ever receive such a request or have any concerns, it's best to reach out to your bank using verified contact methods.

Monitoring Your Accounts Regularly

Maintain a routine of checking your accounts regularly for any unauthorized transactions. Early detection of suspicious activity can prevent further damage. Most mobile banking apps offer instant notifications for transactions, which can help you stay on top of your account activity. If you notice anything amiss, report it to your bank immediately.

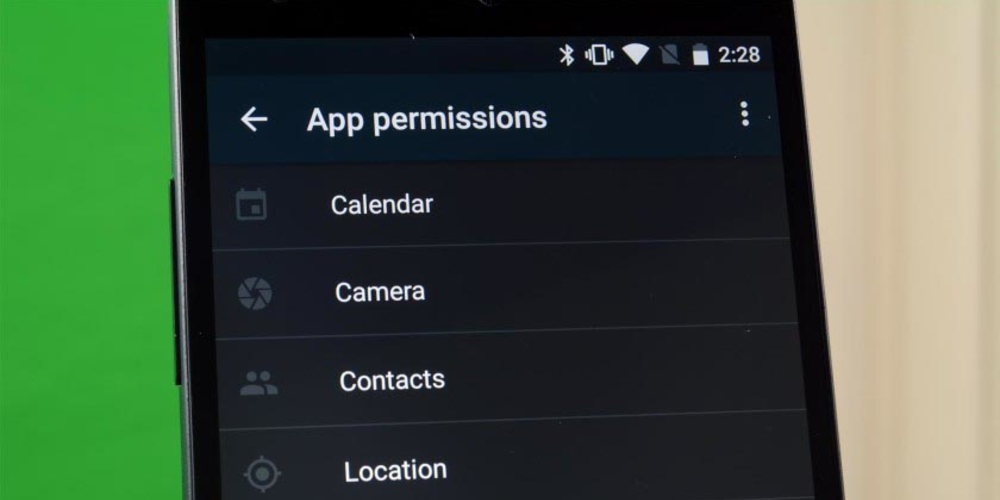

Exercising Discretion with App Permissions

When you install a mobile banking app, it may request certain permissions on your device. Be cautious and consider whether the requested permissions are necessary for the app's function. Granting unnecessary permissions can potentially expose your data to risks. To ensure a clear understanding of the app's data usage and safeguarding measures, it is imperative to thoroughly examine its privacy policy.

Implementing Multi-Factor Authentication

Multi-factor authentication (MFA) boosts security measures by requiring several types of proof before allowing access to an account. This could include something you know (password), something you have (a phone), or something you are (biometric data). Enabling MFA can significantly reduce the likelihood of unauthorized access to your mobile banking app, even if your password is compromised.

Safeguarding Your Personal Information

Be mindful of the personal information you share online. It is important to safeguard sensitive information like your birthdate, home address, and Social Security number, as cybercriminals can exploit these details to commit identity theft. Avoid disclosing such personal information on social networks or public forums. Also, exercise caution if you receive unexpected phone calls or messages requesting your personal data; legitimate banks and institutions do not solicit such information through these channels.

Knowing When to Seek Help

If you have any suspicions of fraudulent activity or if you're worried about the security of your mobile banking application, it's imperative that you contact your bank's customer support immediately for help. They can guide you through the steps to secure your account and investigate any issues. Understanding the governing entity responsible for supervising your bank is crucial. In the United States, for instance, the Consumer Financial Protection Bureau (CFPB) serves as one such oversight authority. This knowledge is important should there be a need to take your banking issues to a higher level.

Integrating Safe Mobile Banking into Your Lifestyle

In the digital era, integrating mobile banking into our daily routine offers exceptional convenience and efficiency. By following the essential tips outlined in this guide, you can confidently navigate your mobile banking app with the assurance that your financial information is secure. Regularly updating your knowledge on security best practices and staying alert to potential threats will empower you to take full advantage of the benefits of mobile banking without compromising your peace of mind. Remember, a secure mobile banking experience is a combination of using the right tools and adopting vigilant habits. Happy and safe banking!

Leave a comment

Your comment is awaiting moderation. We save your draft here

0 Comments